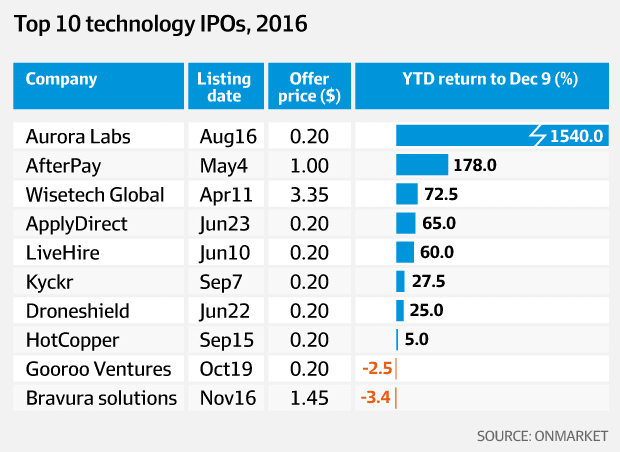

ASX Technology IPOs still offering value in 2017

- By Rob Antulov

- •

- 02 Mar, 2017

Low returns from technology companies that listed on the ASX in 2016 should not dissuade investors from embracing tech IPOs in 2017, according to Jacanda Capital.

Jacanda Capital said it expects investors may be tempted “back to mining IPOs” in 2017 due to the performance of tech listings in 2016.

“Tech IPOs generated a 45 per cent return overall for investors throughout 2016, compared to just 25 per cent for mining IPOs,” the company said.

“However, this figure drops from 45 per cent to just 8 per cent if the 1,380 per cent return generated by tech IPO outlier, Aurora Labs, is excluded from these returns.”

Jacanda Capital executive director Philip Alexander said investors were also “far less certain” on how to judge a tech IPO as they are “still somewhat of an unknown quantity to many Australian investors”.

Recent changes by the ASX to tighten its listing rules however means many riskier, lower revenue tech companies have been removed from the IPO pipeline, the company said, as well as improve the quality of tech listings.

“Recent measures taken by the ASX to restrict risky early-stage companies from reaching IPO stage should act to restore some faith in this potentially positive sector, and make way for stronger tech companies with greater revenues than we’ve been seeing in recent years,” Mr Alexander said.

“It’s our belief that there are still returns to be made in the listed technology sector, as long as investors seek out companies that demonstrate strong growth, recurring revenue, scalability and a strong Asian or global growth story.”

This Blog was first published as an article by InvestorDaily in March 2017.

-500x97-1920w.png)